Finding a Reliable Bookkeeper

For many small businesses, finding a reliable bookkeeper can be a real challenge. (From price gouging to irresponsible handling of financial data, we’ve seen it all.)

We can be the solution to that challenge. Inkblot offers bookkeeping and payroll services to small businesses at an affordable monthly rate that fits most business budget and needs.

Don’t hesitate to contact us today to see how we can help manage your business’ books.

Inkblot Business Services offers bookkeeping, payroll, and state tax filing to businesses located in Washington state.

Inkblot Business Services is owned and operated by a bookkeeper with 7+ years of experience serving a wide variety of companies, including restaurants, plumbers, construction contractors, RV parks, and medical clinics.

Inkblot Business Services is owned and operated by a bookkeeper with 7+ years of experience serving a wide variety of companies, including restaurants, plumbers, construction contractors, RV parks, and medical clinics.

The starting rate for monthly bookkeeping service for small businesses starts at $350. The price may increase due to the complexity of the work, but most clients fit comfortably within this price plan.

We operate in both Quickbooks Desktop and Quickbooks Online.

Below is an overview of what we offer, including but not limited to:

Financial data management

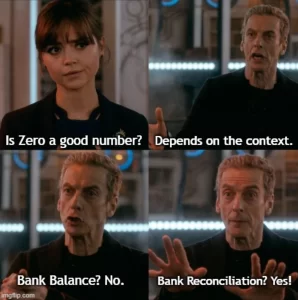

✅ Bank account and credit card reconciliation

✅ Customer billing, invoices, and account management

✅ End of month spreadsheets (Balance sheet, profit and loss statement, etc.)

Sales tax liabilities

✅ Including sales, excise, and B&O tax paid at state level

Employee payroll liabilities

✅ Direct Deposit or printed checks

✅ 940 / 941 Federal tax deposit

Annual Cleanup

As an additional service, we also offer one time annual cleanup. This is a great option to get your accounts prepared prior to filing end-of-year taxes.

From the Inkblot Business Blog

In-House Bookkeeper vs. Independent Contractor

If you’re a business owner who’s made the decision to hire a bookkeeper to help manage your financial records, the first question to ask yourself is if you should hire an in-house employee to fill that position, or if you should partner with an independent contractor.

If you’re a business owner who’s made the decision to hire a bookkeeper to help manage your financial records, the first question to ask yourself is if you should hire an in-house employee to fill that position, or if you should partner with an independent contractor.

In the paragraphs that follow, I'll give my two cents on both options.

Generally speaking, one advantage to an in-house position is that it will probably cost less per hour. Keep in mind, however, that you’re hiring an actual employee, which means that you, as an employer, have certain legal obligations to that person. Additionally, although you might pay less in terms of the person’s wage, you will also be responsible to pay social security, medicare, workman’s comp, and state/federal unemployment taxes for the hours they work.

Why Should I Hire a Bookkeeper?

You probably got into your current line of work because it's something you enjoy doing. But as a business owner, what happens when the administrative part of the business starts to interfere with your passion?

Perhaps you've found yourself at the following crossroads a time or two.

On one hand, you could do the work you're passionate about, the work that makes your company profitable, and the work that motivated you to get into that industry to begin with. Or, on the other hand, you could do the administrative work, and tackle the growing to-do list that's getting in the way of growing your business and bringing in revenue.

Contact us today!

Call or text Jesse: (360) 855-8397

Email: inkblotbiz@gmail.com

Please inquire for rates and references.